Modeling Commercial Property Values in the GTA

By Dr. Maurice Yeates and Christine Jackson

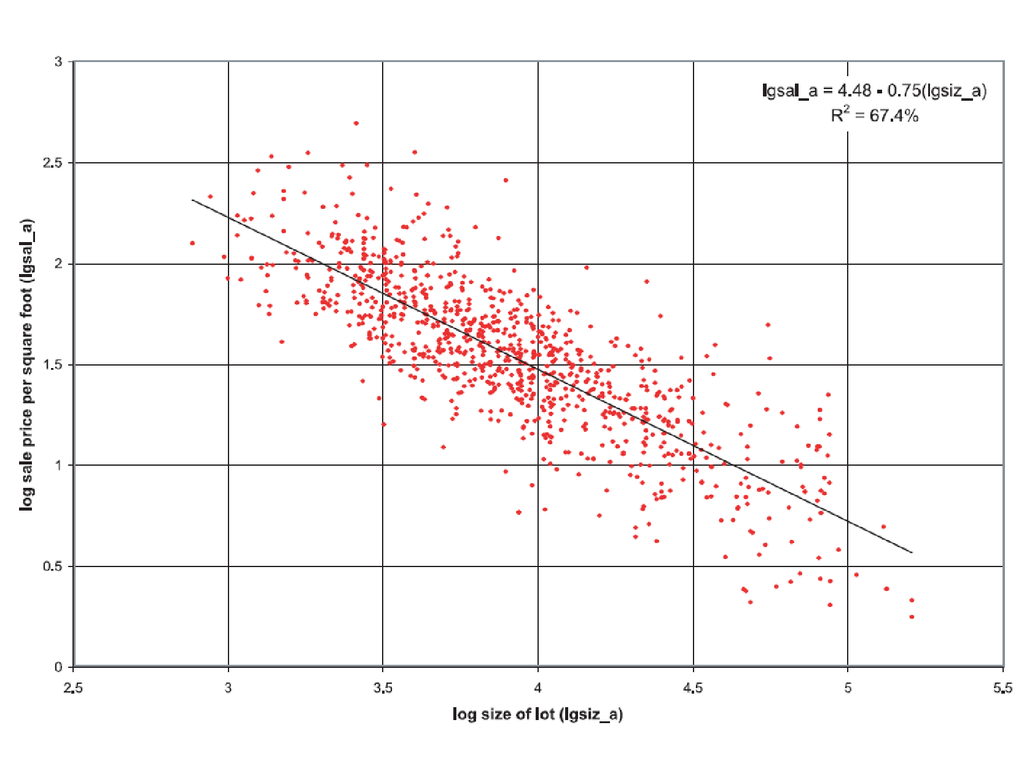

Compared with residential property valuation, there is little research on modeling commercial property values (price per square foot), particularly in outer suburban and exurban locations. This paper utilizes a file of 931 commercial property sales that occurred in regions outside the City of Toronto in the Greater Toronto Area during a five-year period from January 1998 to February 2003. A principle feature of these sales, and one that has to be taken into account in any modeling exercise such as this, is that they occur in highly clustered locations due to the nature of commercial zoning. Two modeling approaches are explored: (i) multiple regression analysis (MRA) using independent variables related to the characteristics of the property, the neighbourhood in which it is located, the stage in the property price wave, and locational characteristics; and, (ii) MRA, with the same independent variables but also including a spatial autoregressive term to reflect clusters. The results indicate that both approaches generate reasonably powerful models (R2s around 80% to 82%), but that the MRA with the SAR term is more parsimonious.