Spatial Implications of the Residential Property Tax

By Dr. Maurice Yeates, Dr. Tony Hernandez, and Matthew Emmons

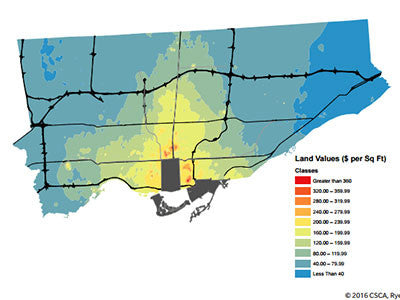

Property taxation is used by Canadian municipalities to fund key services (i.e., education, police, fire, social services, etc..) and support infrastructure (i.e., public works, utilities, etc..). Residential property taxes can be applied as a flat-rate (as is the case within the City of Toronto) or a progressive tax whereby the tax rate increases with the estimated property value. Using a hedonic simulation for the City of Toronto, based on a large sample of residential property values data provided by Brookfield RPS, we examine the spatial implications of applying a progressive tax in Toronto. Our analysis suggests that alternative taxation approaches could potentially be used as a mechanism to shape city building and raise revenues to fund local services & infrastructure.